Joshua Faseesin, an officer of the Nigeria Security and Civil Defence Corps (NSCDC), has accused Sterling Bank of blacklisting his Biometric Verification Number (BVN), over an alleged illegal transaction he knew nothing about.

Faseesin, who operates a United Bank for Africa (UBA) account, told FIJ that his ordeal began when he attempted making a withdrawal from an ATM on November 18, 2021, but was unable to do so due to a restriction order issued by Sterling Bank.

“On September 20, 2021, I was on my way to somewhere when I got a call from someone who first introduced himself as a Sterling Bank official before going on to say he wanted to remind me of the loan I had previously collected form the bank,” Faseesin said.

READ ALSO: ‘N2.8m, No Car’ — Another Customer Says Afialink Int’l Duped Him

“I immediately told him I was not a Sterling Bank customer. I also told him I had never opened a Sterling Bank account in my life. I have never had anything to do with them. I also told the officer to go back and check their records properly. The official said he would call me back, but I never got to hear from him again.”

Faseesin said he never really took the conversation seriously until it became impossible for him to withdraw money from his account in November 2021.

“I tried withdrawing N12,000 from my UBA account in November for someone but I was unable to. I also noticed that my available balance was not displayed on the ATM monitor and the same thing happened when I logged into my mobile application as well. With this, I was forced to quickly visit a UBA branch to logde a complaint,” the customer said.

“It was at the branch that I was told that my account had been frozen because my BVN had been blacklisted by Sterling Bank. They also advised me to visit any of their branches for a resolution.

“I visited a Sterling Bank branch in Oke-Ilewo, Abeokuta, where I explained my situation to the official I met at the branch’s customer care desk.

“After the lady first checked their system, she confirmed to me that I had no account with them. She was unable to trace the transaction. From the customer care desk, they referred me to another official in the branch who first used all my names to search for a Sterling Bank account number that might have been opened in my name but was unable to come up with anything meaningful.

“But the moment he used my BVN to search for same, the strange account number that had been opened in my name popped up. They also told me that the account has a N3,950,000 debit linked to it. I was told some fraudsters had used the account to perpetrate a fraud worth the said amount. This was how I began crying right there inside the branch.”

READ ALSO: Customer’s N16,500 Still Held by GTBank a Month After Failed Transactions

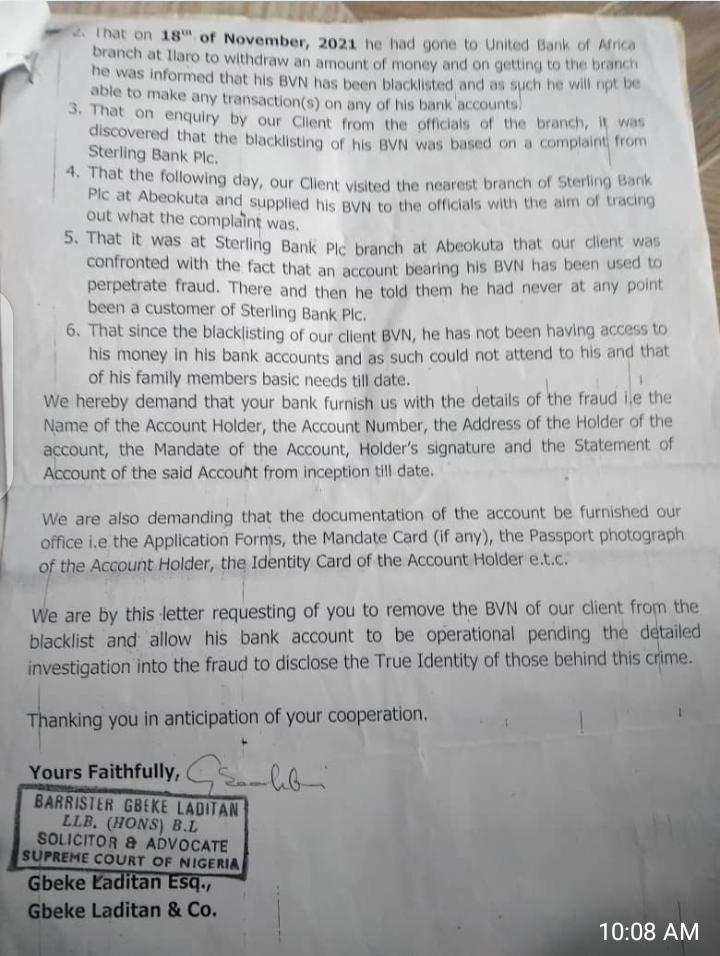

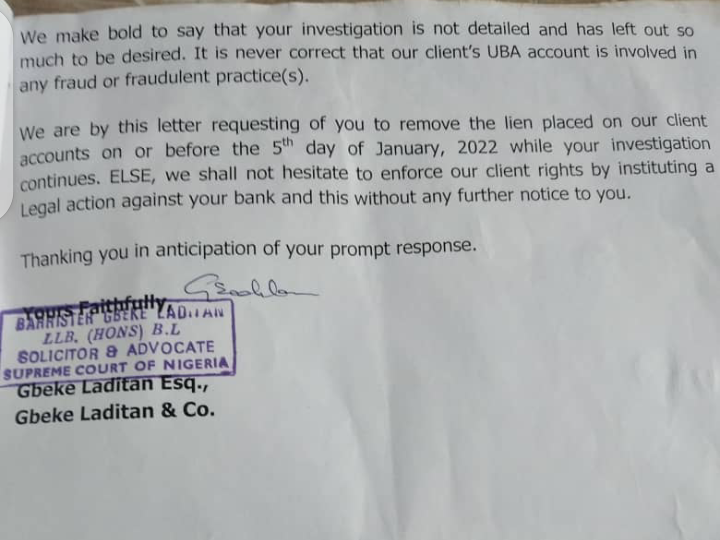

Fajeesin said he had since hired the services of a lawyer so he could be cleared of any wrong doing. He also said he wrote petitions to the Federal Competition and Consumer Protection Commission (FCCPC), the Central Bank of Nigeria (CBN), the National Assembly and the Public Complaint Commission but nothing concrete had come out of it.

“Since then, I have not been able to access the money in my UBA account. People now contribute money for me to feed. I am also no longer able to pay my children’s tuition fees as a result of the incident. Sterling Bank has continued to punish me for an incident I do not know anything about,” Fajeesin said.

When FIJ contacted Sterling Bank via email, an official, who simply identified as Nelson, said she could not give Faseesin’s account information to a third party.

Subscribe

Be the first to receive special investigative reports and features in your inbox.