Scores of Nigerians invested their hard-earned incomes with Standard Alliance Insurance Company, hoping to recover their Return on Investment (ROI) alongside the invested funds after five to 10 years but several years later, they are left stranded and with failed promises.

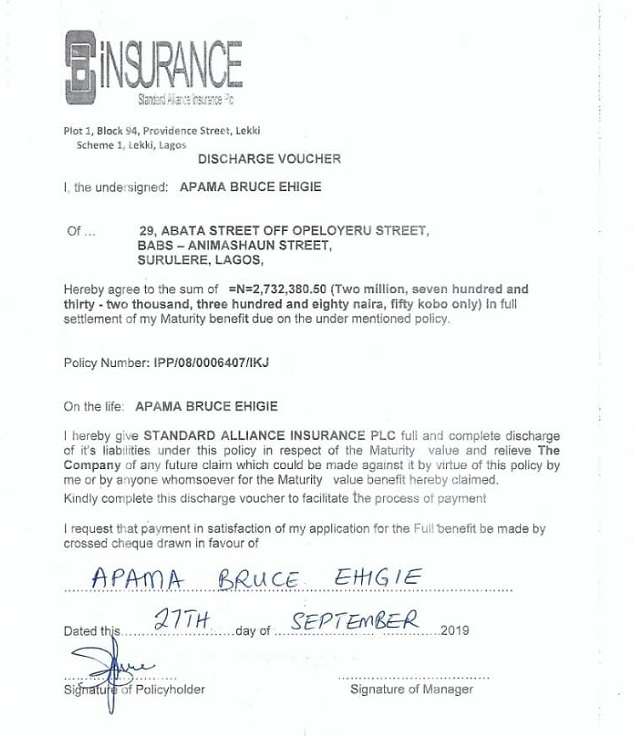

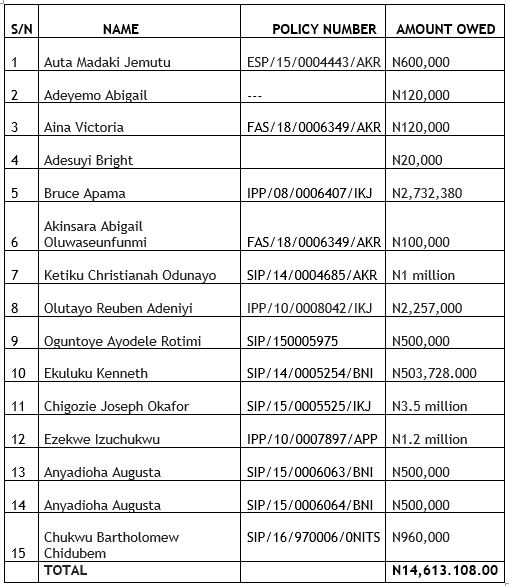

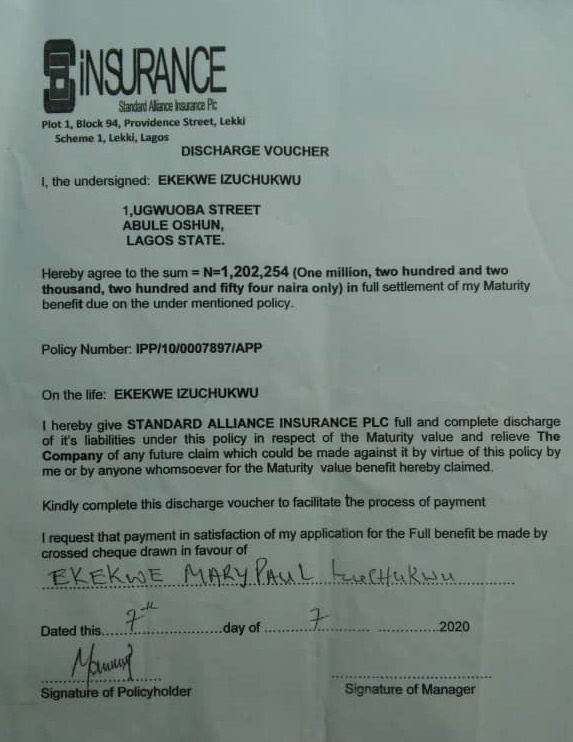

Although the figures are likely higher, FIJ was able to recover evidence of payments from 15 policyholders, amounting to a sum of N14.6 million that the insurance company is in debt of.

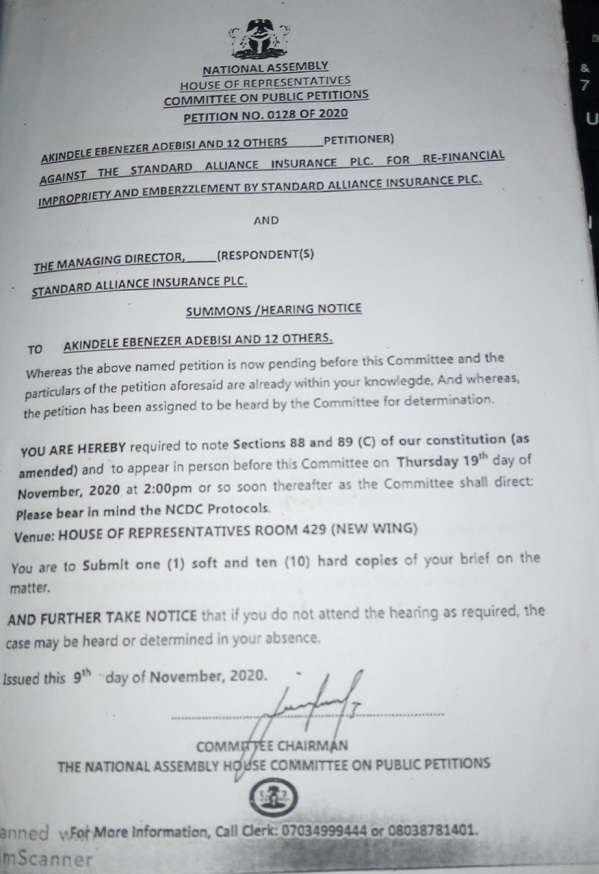

In November 2020, their petition before the House of Representatives on the allegation of financial impropriety and embezzlement against the insurance company was heard and recommendations were made for their reimbursement. But, seven months after, nothing substantial has happened.

Since January, FIJ has consistently reported how rampant investment fraud has become in Nigeria, but the issue with Standard Alliance Insurance Company is slightly different; while most of all these fraudulent companies terminated operations after duping people, Standard Alliance is still operational, accruing money from new but ignorants investors. That single difference is the slim hope the investors have till date, although it is now fading as the years go by.

READ ALSO: How Global NGO Closed Nigeria Chapter after ‘Young Leader’ Jeremiah Offor’s N16m Fraud

COUNTING DEBTS

Auta Madaki Jemutu, an indigene of Nasarawa State who works with a bank in Ekiti, has a daughter studying at the Benson Idahosa University in Benin State who was supposed to begin her exams on Monday, but the outstanding school fees of N411,000 would not make her write her papers.

Jemutu had a N1.2 million policy with Standard Alliance as of 2020. After much pleading, he was paid half of it in early 2021.

The remainder, which is not forthcoming, is enough to settle his daughter’s fees and some other family bills. He had taken the policy “as a protection for my children’s education against any financial shock”.

“The company’s failure to pay at maturity is now causing me untold hardship,” he said.

Like Jemutu, Odunayo Christianah Ketiku’s son at the University of Prince Edward Island in Canada almost lost a semester in 2020 because the widowed mother also found it hard to pay his school fees.

Out of N2.87 million, which Ketiku was owed by Standard Alliance since April 2018, she was paid N1.87 million in bits between 2019 and March 2021.

While Ketiku is yet to be paid all her Surrender Value to date, her experience with the company prompted many others to insist they would not collect their money in parts. “It wouldn’t be worth it,” one of them said.

From the record FIJ obtained, the owed policyholders are not just in Lagos, the southwest state where the company is headquartered. The investors are spread across other regions of the country, especially the South-South and South-East.

SOME INVESTORS WHOSE DUES HAVEN’T BEEN PAID

DECEPTIVE STAFF, HOPELESS INVESTORS

“How I wished you had followed us to their office in December,” Bruce Apama, one of the investors, said during his first meeting with FIJ. “Some old people brought mats to the insurance company in protest; they said they would not return home untill their money had been paid.”

In March, FIJ accompanied two investors to the Standard Life office. The outcome was as futile as the investors had predicted.

Going past the entrance could also require tactics because the gatemen had been instructed not to grant access anyone who came to demand their money.

“They have learnt their lesson from what happened in December,” Apama said. “They will just tell you to write your name down but they will never allow you to see their manager.”

We told them we were business delegates of a company with huge stakes in Nigeria. The gateman peeped into the car and later opened the gate.

By the time we approached Ruth Apata, the secretary, on the counter, the shock on her face was palpable because she recognized one of the two investors. Although it was too late to send any of us back, she would not allow the investors go beyond the reception, insisting the manager was on a weeklong leave.

For more than thirty minutes, she tried to convince the visibly angry investors that they would recover their money in a short time.

“Even if you decide to vandalize any property here, it won’t bring your money today,” she said.

“This is not the first time that people will come here to break our glass doors and still leave without any money. The company is working on paying all of you. I can assure you of that; only that I cannot show you how far we have gone with the plans. But by the grace of God, you will get paid before the end of June.”

Someone at the company subsequently hinted the investors that they would not be paid unless they “put pressure on S.A Insurance, especially you people that have millions of naira”.

She added that: “June is just a tentative period. What I know is that the company is only trying to pay off people with little money like N100,000 to keep those ones quiet.”

THE RED FLAG STANDARD ALLIANCE FAILED TO YIELD

FIJ gathered that the company had not held its Annual General Meeting (AGM) for two years. Unlike past years, its account has also not been accessible to the public since 2018 — an action that suggests financial impropriety.

In the report signed by Olugbemiga A. Akibayo on August 7, 2018, BDO Professional Services, the company’s independent auditor, admitted to Standard Alliance’s liquidity challenge.

“Without qualifying our opinion, we draw attention to the shortfall of N1.477 billion in assets, indicating that the Company was not able to generate adequate liquid assets to cover the policyholders’ funds,” read a part of the staement.

“Due to the large number of policies underwritten by the Company, there is a risk that the revenue recorded in the financial statements and the flow of premium information from the underwriting systems to the financial reporting ledger may not be completely accounted for.”

In June 2021, following several complaints against some defaulting insurance firms, the Nigeria Insurance Association (NIA) expelled Standard Alliance and two other insurance companies, Industrial and General Insurance Company Limited (IGI), Niger Insurance Plc for failing to deliver claims to policyholders as expected.

As a result of the expulsion, the companies will not be able to participate in the Federal Government’s group life insurance policy and other businesses, as the NIA would not issue them letters of membership, a requirement for securing big businesses in the sector.

NO HOPE FROM NATIONAL ASSEMBLY

Owing to the petition to the House Committee on Public Petitions by 13 investors in August 2020, the committee, in November, summoned both parties to a panel where their matter was determined.

The petitioners that were present at the hearing stated that the committee headed by Jerry Alagbaso, the Chairman of the House of Representatives on Public Petitions, recommended that the company should pay the investors within six months. But as of July 8 2021, the company had yet to pay the investors.

Ordinarily, the committee ought to submit its recommendation to the entire chamber for deliberations before a verdict is passed, while a copy of the recommendation is also sent to both parties involved in the petition.

However, none of the 13 petitioners has received the document stating the committee’s recommendation, yet they are not sure their case has been deliberated upon.

Alagbaso didn’t answer his call or reply to the text message sent to him over the matter.

STANDARD ALLIANCE’S APPREHENSIVE HR MANAGER

For seven days, FIJ tried to reach the Human Resource Manager of Standard Alliance for a reaction, but she was evasive. Three different mobile numbers were used to call the HR Manager simply identified as ‘Nkem’ but she always hung up as soon as she heard it was a journalist.

She subsequently barred all the journalist’s numbers from her lines. After multiple failed trials, another text message was sent to both lines, but she did not respond.

Augusta Anyadioha, an investor who is still being owed, told FIJ that her action was not surprising.

“She would not answer you if she hears you are calling because of their debts. That is what they do to us too,” she said.

Subscribe

Be the first to receive special investigative reports and features in your inbox.

2 replies on “National Assembly Watches as Standard Alliance ‘Escapes’ with Investors’ N14.6m”

This is quite impressive but this is Nigeria where absolute power corrupts absolutely. The rich climbs the poor to get richer and impoverish the less privileged. These 13 investors are the one’s that you know, there are thousands out there that are not talking. I was reliably informed that some of the investors had died in the process of getting their hard earned money back. We learnt that the CEO of the company is powerfully connected even to the top seat of government. All I know is that “when you make other people’s children cry, your own children will not laugh”.

Thank you FIJ for this impressive investigation. But this is Nigeria where corruption is at its peak in both the public and the private sectors. The rich climbs the poor to get richer and impoverish the less privileged. These 13 investors are the one’s that you know, there are thousands out there that are not talking. I was reliably informed that some of the investors had died in the process of getting their hard earned money back. We learnt that the CEO of the company is powerfully connected even to the top seat of government. All I know is that “when you make other people’s children cry, your own children will not laugh”.