In July, Moses Ajayi, 34, was in dire need of money and sought the help of friends and family members. Unfortunately, no one was able to assist with the N7,000 he needed.

While speaking with a family friend, he was advised to borrow whatever he needed online. He heeded the advice and borrowed the money from Nairaplus, an online quick loan outfit.

READ ALSO: Court Grants Rahmon Adedoyin Access to Medical Care in Detention

Initially, Ajayi was impressed no collateral was requested. But things would take a dramatic turn.

FIRST OF ALL, NO MONEY WAS RECEIVED

After Ajayi had successfully applied for the loan on Nairaplus application, a congratulatory message was displayed on his phone screen. In the message, he was told his account would be credited in minutes.

READ ALSO: Sokoto Governor Makes Ninth Condolence Visit to LGA in About One Year

“First of all, no money was received from Nairaplus. I applied for N7,000 on July 14. The loan was supposed to be for 7 days. This means I was supposed to make repayment by July 21. However, I waited endlessly to receive the payment but it never came,” Ajayi told FIJ.

The graduate of Physics said he contacted the customer care unit of NairaPlus to let them know that he was yet to receive the promised loan, but no one was ready to listen to his complaint.

READ ALSO: Agents Lease 11 Apartments to Over 100 People in Lagos, Flee With N60m

“I also sent them a mail, but till now, no response has been received from them, not even an acknowledgement,” Ajayi said.

MOVING ON AT A COST

Ajayi concluded Nairaplus had chosen not to lend him the money and decided to move on, but the quick loan outfit returned, asking him to pay up.

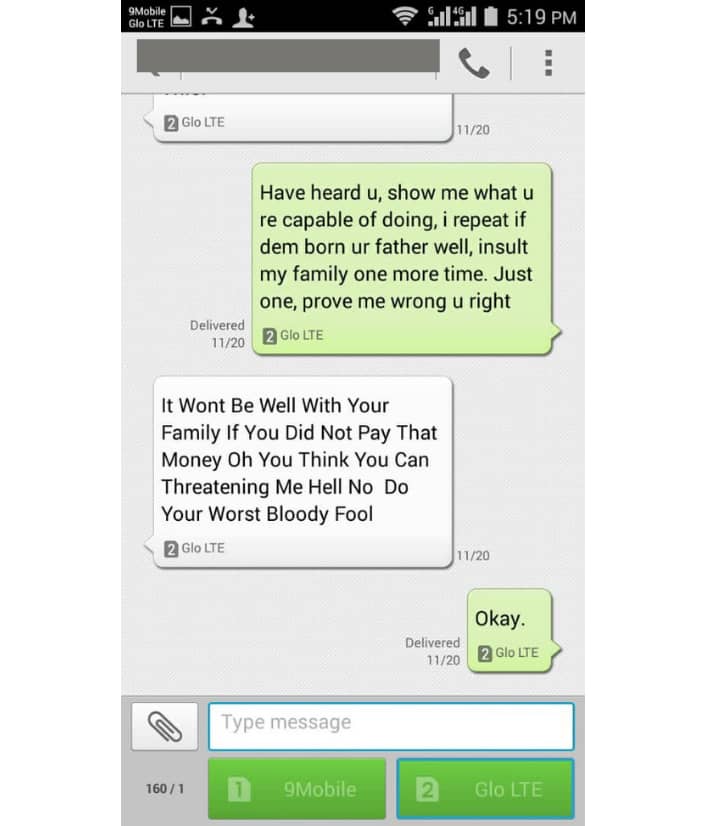

“I was angered by the message and fought the agent I spoke with over the phone. Over a sum that was never disbursed? I even offered to come with a statement of my account to their office if they would allow me, but the agent was not even ready to listen,” Ajayi told FIJ.

READ ALSO: I Risk Life in Prison for Being a Journalist, Says Nobel Prize Winner

He also said he was subjected to several rude comments and remarks from the company’s agents and, at a point, he stopped communicating with them.

FRIENDS AND FAMILY MEMBERS RECEIVED MESSAGES

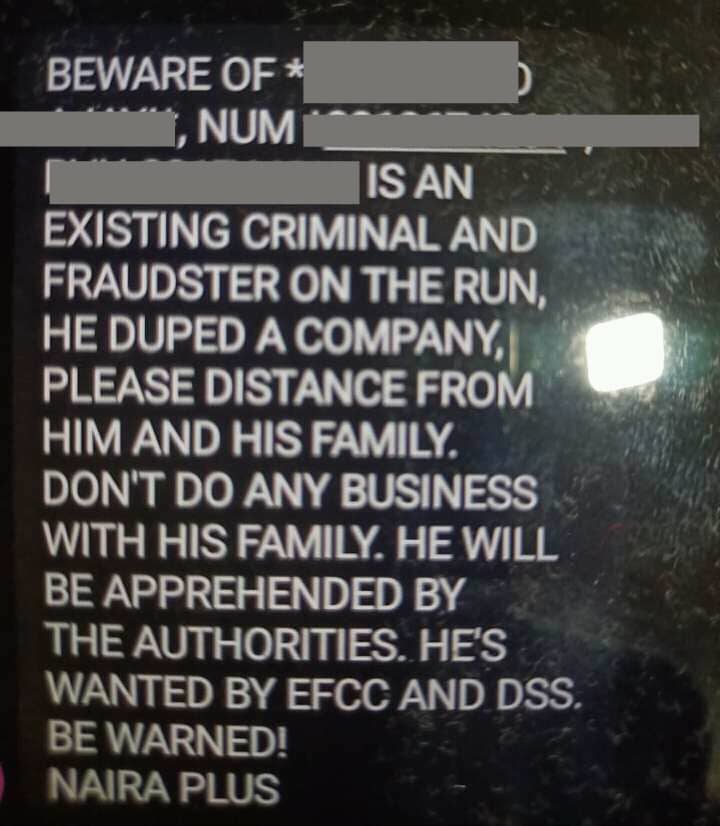

Ajayi said friends and family members on his phone contact list started receiving messages from Nairaplus, with a claim that he was a fraudster.

“My phone started ringing non-stop with concerned family members and friends calling to inform me about the messages they had received. Church members, who happened to belong in the same choir group as me also called. My landlord forwarded the damning message he had received to me,” he told FIJ.

READ ALSO: CDD: Inadequate Staffing, Resources Limiting Nigeria’s Anti-Corruption Agencies

“The worst part was that my father-in-law, who never really wanted me to date her daughter, also got the message. It was too much to bear. I almost had suicide thoughts.”

He said the relationship he had built for six years was almost ruined because of the damning messages the money lending company sent.

He petitioned the Economic and Financial Crimes Commission (EFCC) and National Information Technology Development Agency (NITDA) about the incident but got no response.

MISS REPAYMENT BY A DAY AND INCUR THE MONEY LENDER’S WRATH

A lady, who simply identified as Edith, also shared her unpleasant experience in the hands of a similar online quick loan outfit called 9cash with FIJ.

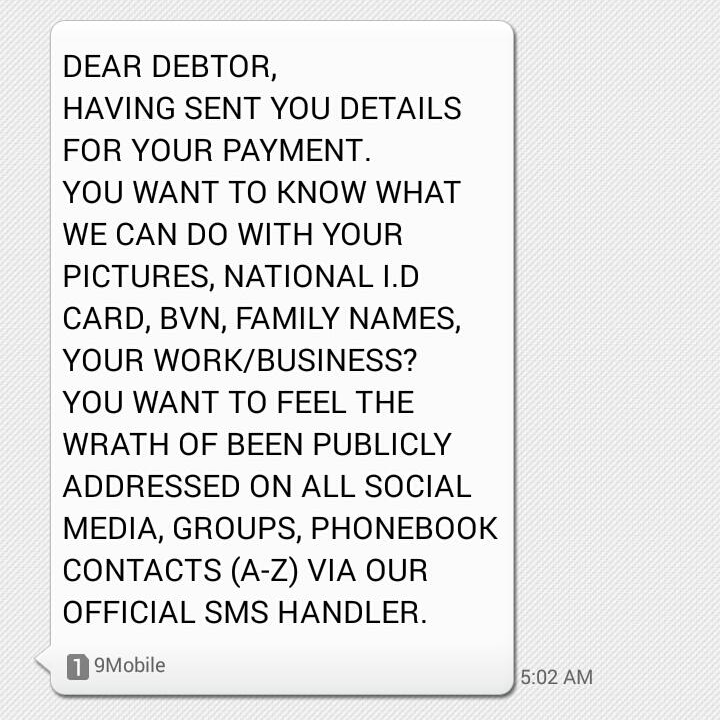

“I missed repayment by a day and I saw hell within 24 hours. They went to my Facebook page and got many of my pictures from there. They now started sending WhatsApp messages containing my picture to my contacts, calling me a criminal. It was an embarrassing period for me,” Edith said.

READ ALSO: Over 100 Now Homeless in Lagos as Gov’t Demolishes Houses Against Court Order

“In the end, my close friends had to rally round to ensure that I made the payment.”

The 27-year-old hairdresser said she was not sure she would ever consider the option of borrowing money from an online money lender again.

NITDA SANCTIONS SOKOLOAN

In August, Sokoloan, a quick loan outfit, was fined N10 million by the National Information Technology Development Agency (NITDA) for breaching its customers’ data privacy.

This decision was hailed by some, with the hope that such measures would prevent other money lenders from sending defamatory messages to the contacts of defaulting borrowers.

READ ALSO: Autopsy Report on Murdered OAU Student Out, But Police Yet to Show Family

“I am not sure the sanction on Sokoloan has changed anything. These companies are still sending messages to peoples’ contacts. They don’t even give you any grace if you default. Times are hard and people are liable to defaulting. But if you give them a grace period and they refuse to pay, you can then take actions. It is wrong to resort to severe measures of sending messages to people’s contacts without first giving them grace periods,” Edith told FIJ.

FIJ made several calls to the service lines of Nairaplus and 9cash for reactions but they were not answered. Text messages sent to them were also not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.