Over 200 Fidelity Bank employees across Nigeria have received their disengagement letter after attending regional training in specified states. The disengagement letter came a few weeks after they were invited for “training” and it was followed by their ex-gratia — a sum of N200,000 irrespective of years of service.

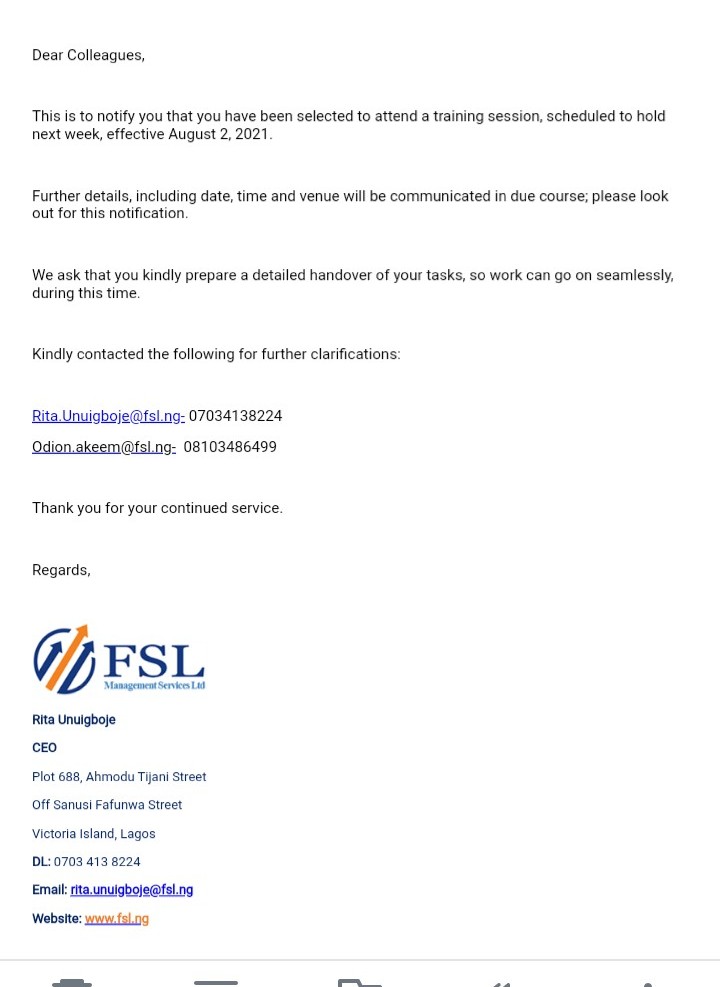

In July, some employees of the b ank woke up to a letter announcing their selection for training. However, upon attending the training, they returned home with the news that they no longer had a job.

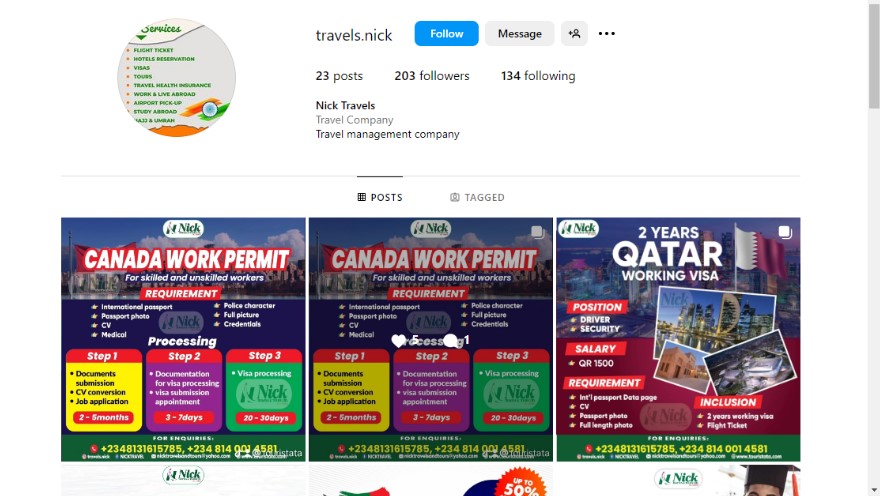

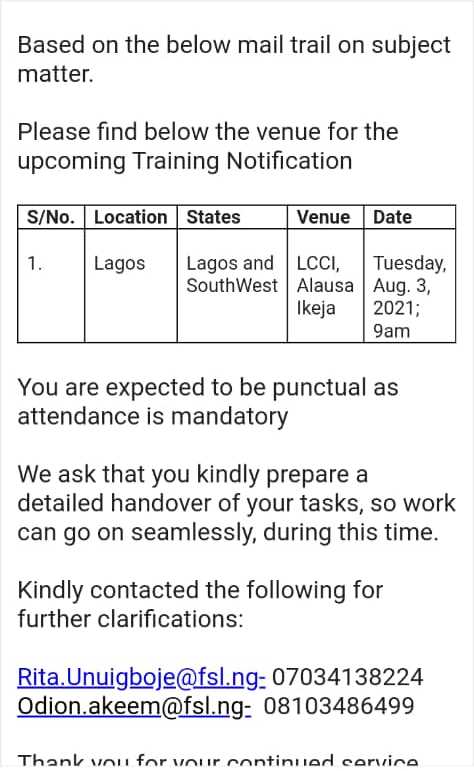

According to the email received by each of the laid-off staff, they were to attend a training on the date specified, at a location based on the region of their workplace. Workers in the South West attended the regional training in Lagos, while others attended in places such as Abuja and Kano.

“None of us knew what the training was about. But since it was from the bank, we attended and were taught how to become POS operators. I attended the training at Lagos Chamber of Commerce, Ikeja.” Tola (not real name), one of the retrenched, told FIJ.

After the training, participants were addressed by Akeem Odion, Head of Operation, Fidelity Union Securities Ltd (FUSL), who told them that they no longer had jobs with the bank. He promised that the bank would pay them some sort of remuneration but said he had no idea how much.

Another of the dismissed employees, Patricia (not real name), explained that she had to travel with pregnancy, enduring the discomfort only to reach the training and be told verbally that they had been sacked.

“People from different branches attended the training as specified in the mail. I travelled to Lagos from Ado-Ekiti with a three-month pregnancy, only to be told during the training that I no longer had a job. Why didn’t they send an e-mail? Sending the mail directly would have saved us a lot of trouble,” she said.

Following the verbal announcement, emails notifying them of their disengagement followed a few days after. However, the email left a bitter taste in the mouth of the employees as it stated they would be paid an ex-gratia, rather than a severance pay as many of the employees expected.

“Rather than tell us directly that we had been sacked, they organised a training to teach us to become independent POS operators who will still make money for the bank even when they sack us,” Idowu (not real name said).

“We know we cannot work for Fidelity forever, but all we want is to be paid our entitlement. I cannot put in 10 years and 9 months only to be given that amount.”

All retrenched employees received an ex-gratia amounting to an average of N200,000, irrespective of their years of service. Tola (not real name) explained that he had given a good part of his life to the bank and therefore deserved a good severance package and not an ex-gratia.

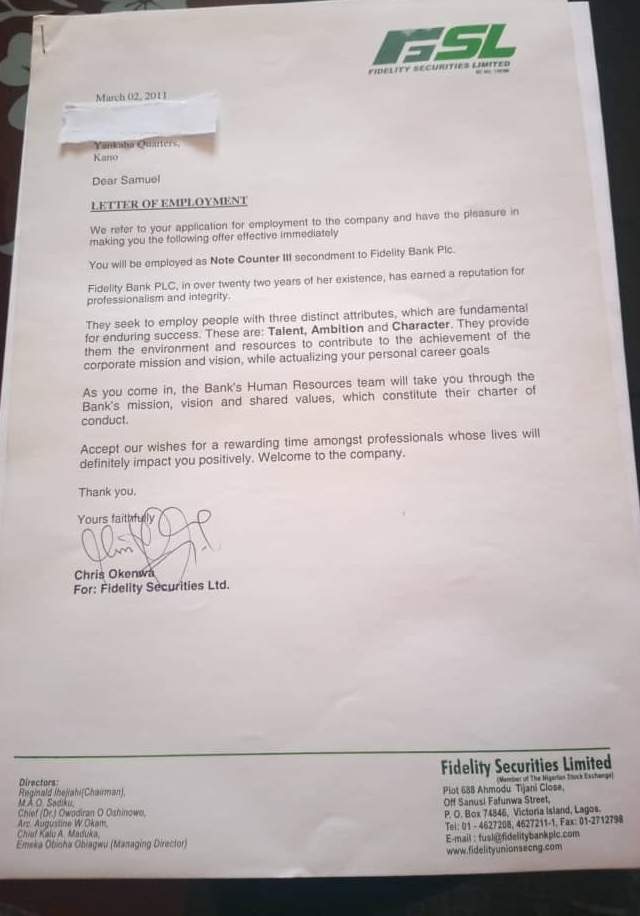

Tola was employed in 2007 by Fidelity as a Fidelity Union Securities Ltd (FUSL) staff member with an Ordinary National Diploma (OND). Although promises were made that he and many other note counters would be made full staff if they pursued and tendered their Higher National Diploma (HND) or undergraduate egrees, they went unfulfilled.

Tola is not the only FUSL employee who has been with Fidelity for that long. According to him, several others spent up to 10 years, more than 10 years and even 23 years. All of them were laid off with only N200,000 as compensation.

All efforts by the retrenched staff to see to it that a worthy compensation that matches their contributions to the bank is paid has been futile.

“This is not the first time that Fidelity Bank is doing this. In 2017, when the drivers were in our position, they protested and argued,” Tola said. ” It was later decided that they would be paid N100,000 per year for each year that they worked in the bank. We deserve the same, if not more.”

In 2017, reported that about 50 drivers who were sacked barricaded the bank’s headquarters on a Monday morning over the non-payment of their severance packages.

Also, in 2018, drivers of the bank held a protest over the non-payment of their entitlements.

When FIJ contacted Akeem Odion, Head of Operations, FSL, he said he could not make any comment on the phone. He requested that the reporter come down to his office for answers to questions asked.

Sheikh Muhammed, Secretary, National Union of Banks, Insurance and Financial Institution Employees (NUBIFIE), an affiliate organisation of the Nigeria Labour Congress(NLC), told FIJ on Friday that the organization had been made aware of the ongoing disagreement and it was working.

“I have received the report and I have instructed that they collect all the grievances so that we can initiate a discussion with the management. We are working on it,” Sheikh said.

Subscribe

Be the first to receive special investigative reports and features in your inbox.