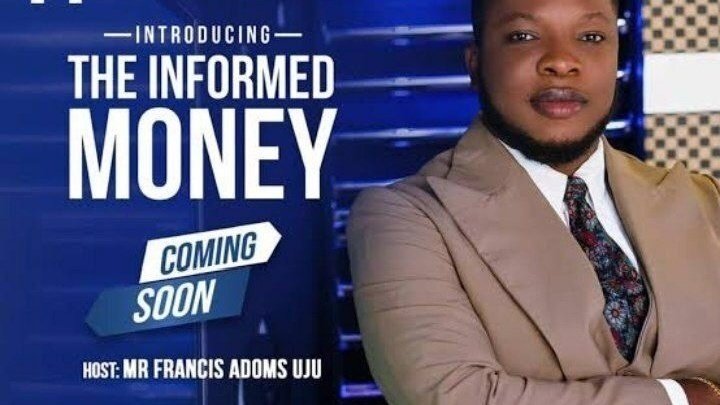

Originally registered in November 2018 and owned by Adoms Uju Francis, Addy Finance and Investment Ltd., rolled out its wide range of investment opportunities in 2019, promising investors a monthly return on investment (ROI) of 13 to 25 percent.

During the same period, the company introduced its thousands of investors to two investment cycles of six months and 12 months, with options of termination at the end of pre-agreed cycle and rollover to mark the beginning of a fresh cycle.

For close to 16 months, the company, which had offices in Egbeda, Ikeja and Lekki, all in Lagos, continued to meet its investors’ expectations by promptly paying ROI as agreed.

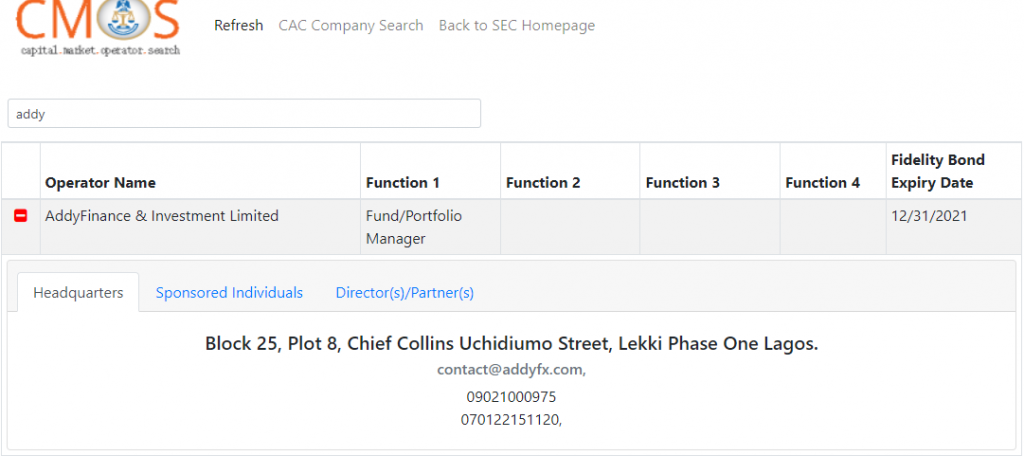

During this period, the company also managed to get itself registered with the Securities and Exchange Commission (SEC) as a recognised fund and portfolio manager.

However, by late May, expectant investors became disappointed as they could not receive their benefits for the month from the company.

READ ALSO: Akor Philip Wouldn’t Pay Investors Their N10bn, But his Wedding Cake Cost N4.5m

In the end, the inability of the business that prided itself mainly on foreign investment trade (forex) to pay investors for the month, announced an impending wave of investment disaster.

A CAREFUL BUT NOT TOO CAREFUL INVESTOR

“I first got to know about the investment in 2020. I had many friends that were already investing in the company’s schemes and were getting their ROI regularly. Despite the attractive returns they got, I still chose to hold back because I felt the returns were ridiculous for a financial manager that claimed to be genuine.

However, I let down my guard in May when I learned that the company was now duly registered with SEC. That gave me the confidence that nothing could go wrong, and I invested N12 million in the scheme. That eventually became the biggest financial mistake I have ever made in my life as both capital and ROI now appear to have disappeared,” an investor, who wished to be identified simply as Akpai, told FIJ.

A PARTIALLY LUCKY INVESTOR

Another investor, who wished not to be named, told FIJ that she started investing in the company’s scheme in May 2020.

“When I first invested in May 2020, I put in N8 million. I also got the promised monthly ROI regularly. However, in October 2020, when my six-month plan expired, I did a partial termination of N4 million and decided to go for a new one-year plan with the other N4 million.

I would say my situation could have been worse if I had chosen to begin the one year plan with the entire N8 million” she told FIJ.

The investor also said that investors affected by this dramatic turn of events were more than 2,000.

READ ALSO: Freed by EFCC, TheMap’s Anyanso Mma Absconds With Investors’ N7.5bn

“I don’t know the actual amount involved, but I believe we’d be looking at more than N13 billion,” she added.

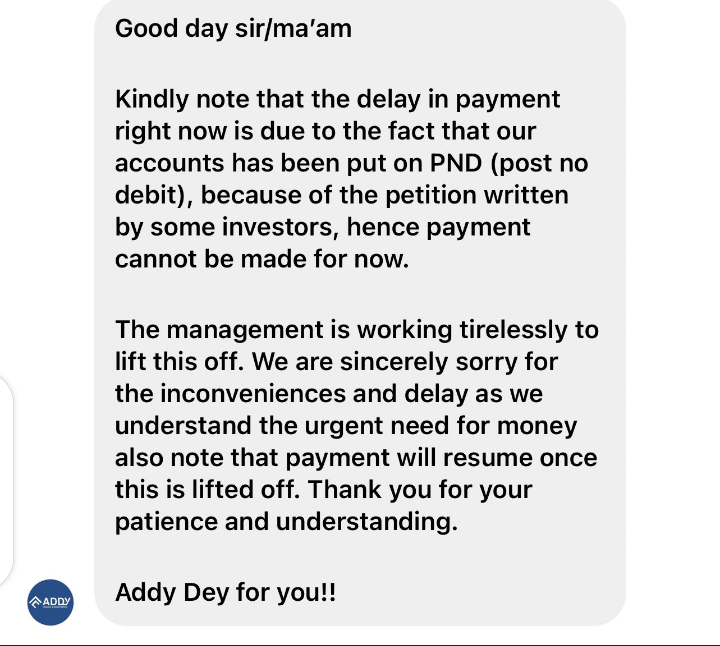

THE CORRESPONDENCE BETWEEN THE COMPANY AND ITS INVESTORS

In early June, the company sent messages to its customers, stating that its inability to pay on time was because some investors had written petitions to regulatory bodies and that had led to the placement of a Post No Debit (PND) order on all its accounts.

READ ALSO: Using Pipminds Ltd, Emem Alban Scammed 2,000 Investors of Billions and ‘Logged Out’

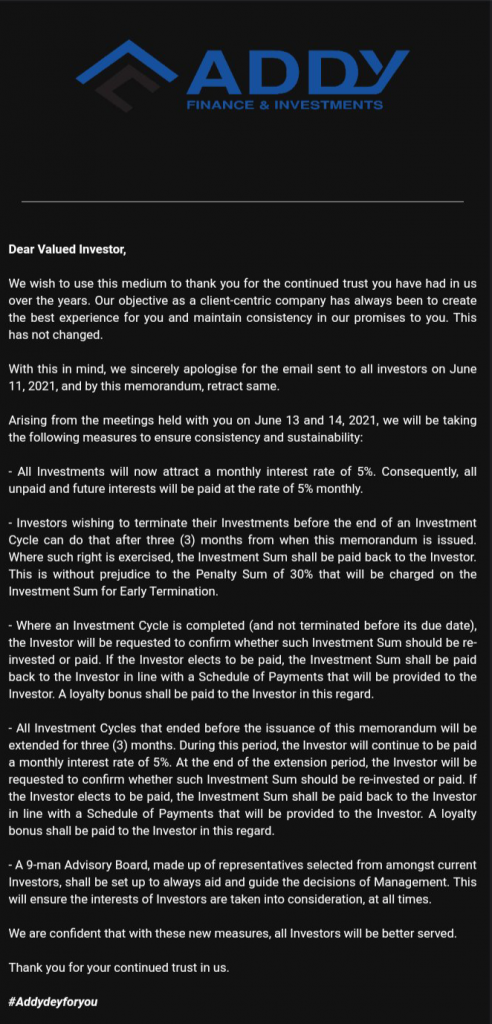

It again issued another statement on June 16, signalling its intentions to continue with business activities and promising a fresh but reduced ROI of five percent to interested investors.

“Adoms knew what he was doing. He had it all planned. He only released the statements to make us feel all was still well. He had already squandered all our money on the purchase of property and expensive trips,” the first investor further said.

INDICTMENT AND WARRANT OF ARREST BY INTERPOL

On June 28, a group of aggrieved investors petitioned the Nigeria Police and subsequently, the International Criminal Police Organisation (Interpol) got an arrest warrant from a high court in Lagos and declared Adoms wanted.

A notice from Interpol stated that Adoms had obtained a total of N52 million and $28,000 from unsuspecting investors under false pretence, using Addy Finance and Investment Limited.

“At the end of the day, Adoms tricked us by making his business look legitimate. It was a Ponzi scheme in disguise. Presently, he has gone into hiding. No one even knows whether he is still in the country or not,” an investor said.

FIJ made several calls to the phone numbers found on the company’s website, but they were unreachable. Messages sent were also not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.