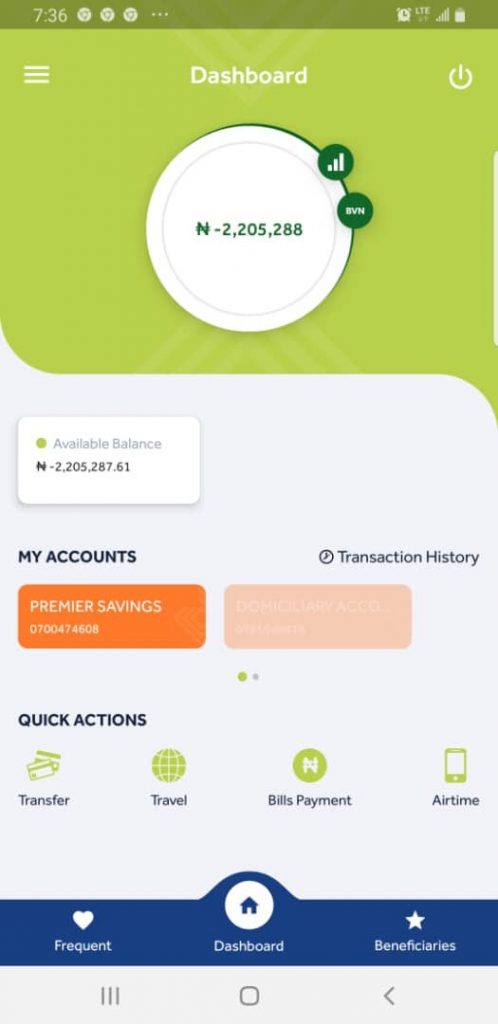

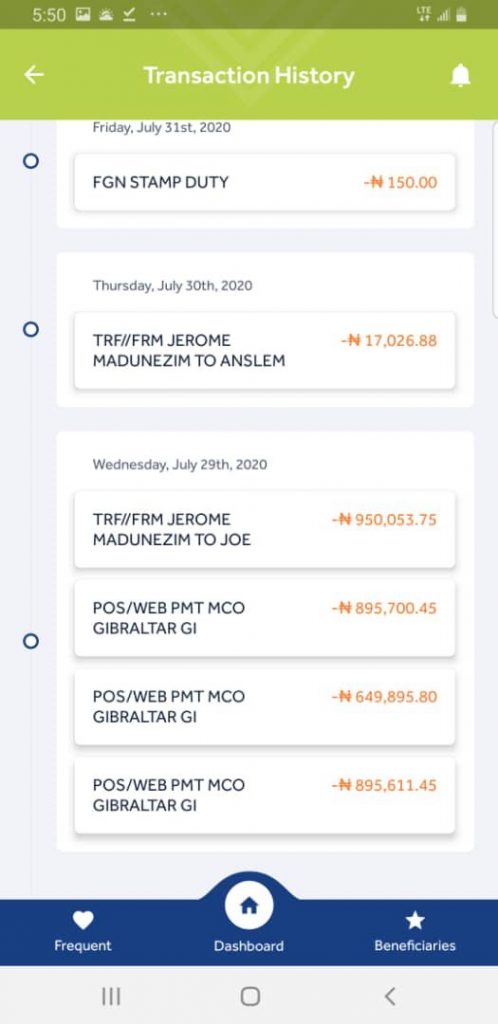

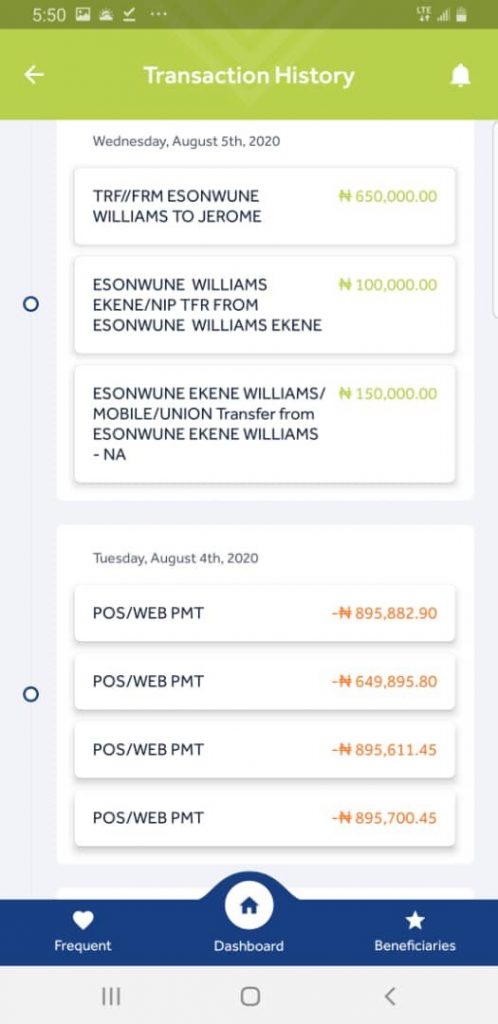

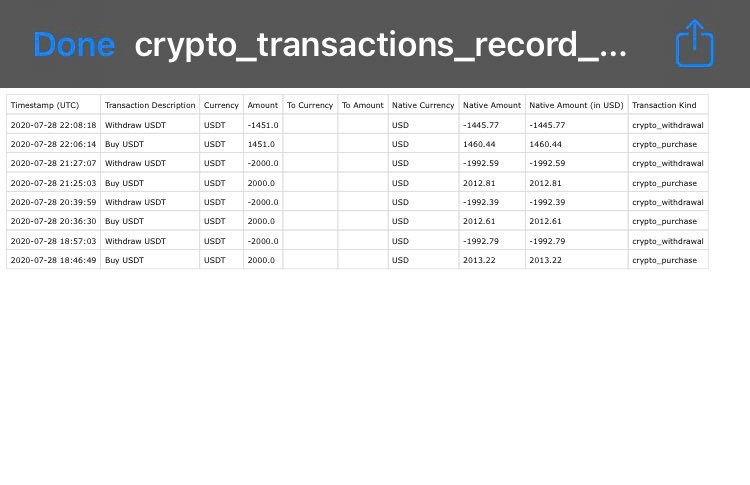

On July 28, 2020, Jerome Madunezim made a $7,451 transaction using his Access Bank Visa card and was debited the naira equivalence. A week after the transaction, Access Bank debited his account ₦900,000 and another ₦200,000, totaling ₦1.1 million, and left him with a -₦2million balance.

Jerome visited the Access Bank Branch on Okpara Avenue in Enugu on August 10, 2020, to lodge a complaint. He was told the bank would resolve the matter in 45 working days, but the promise failed.

“I went back to the branch on the 3rd of November, only for them to tell me that the issue had not been resolved, and that I should give them another 30 days, which I accepted, but only to go back on the 3rd of December for feedback and hear that I was debited for a successful transaction,” Jerome told FIJ.

The bank asked for 30 days to get to the root of the erroneous deduction. On December 3, 2020, Jerome was told he was debited for a successful transaction. He was expected to take it that way and leave the bank. But Jerome disagreed. He said he had never made such a transaction, and his account was almost empty when it was debited.

Jerome believes that it should not be possible to do a transaction with an empty account. By principle, this is true. Most Nigerian banks will decline a transaction if the bank account to be debited has insufficient funds.

“The debit on the first screenshot is similar to the second screenshot, but the difference is that there’s only POS/WEB PMT, no merchant name or name of where the money went to, unlike the second screenshot which has the name of the merchants that received the money, POS/WEB PMT MCO GIBRALTER GI,” said Jerome.

All efforts to rectify this erroneous debit have been to no avail. The bank is also not responding to letters of complaint through his lawyer.

“I was advised to get a lawyer, so I did get a lawyer that December 2020, and he has written a series of letters to Access Bank to reconcile the account, but they didn’t respond. He went ahead to sue them, but they didn’t show up at the court, according to the lawyer,” Jerome told FIJ.

When asked if he took loans with his bank account, Jerome said, “I didn’t take any loan from Access Bank. Funny enough, a friend of mine had the same issue with Access Bank and Zenith. Zenith Bank refunded after a week, but Access took three months after he started a thread on Twitter.”

FIJ made several calls to Access Bank, but they were not answered. At press time, they had not responded to an email sent to them.

Subscribe

Be the first to receive special investigative reports and features in your inbox.